Hydrogen Internal Combustion Engine (H2ICE): The Comprehensive 2025 Guide to Zero-Emission Transport

Updated 28 October 2025

Executive Summary

The hydrogen internal combustion engine (H2ICE) represents a critical decarbonisation pathway for sectors where electrification faces insurmountable barriers. By burning hydrogen fuel in proven internal combustion platforms, H2ICE engines eliminate CO₂ at the tailpipe while maintaining familiar drivelines, established manufacturing networks, and service infrastructure. With leading manufacturers now securing regulatory approvals and entering small-scale production, H2ICE technology is transitioning from laboratory proof-of-concept to commercial deployment across Europe and Asia. This comprehensive guide examines the technical foundations, competitive positioning, efficiency achievements, regulatory landscape, and market outlook for hydrogen combustion engines through 2030 and beyond.

Key Takeaways

- H2ICE engines achieve >40% brake thermal efficiency with optimised designs demonstrating 50%+ BTE using high-pressure direct injection (HPDI), matching or exceeding diesel performance

- CO₂ reduction of 99.95% compared to Stage V diesel engines; NOx emissions controllable to <0.02 g/kWh with lean burn and selective catalytic reduction (SCR)

- Leading manufacturers including JCB, Cummins, MAN, Toyota, HD Hyundai Infracore, Kawasaki, and ULEMCo have secured EU type approvals or are entering production 2025–2030

- Small-series production underway: MAN offering 200 hTGX units in 2025; JCB approved in 10 European countries; HD Hyundai targeting early mass production

- Complementary to fuel cells, not competitive: H2ICE suits high-utilisation, rugged duty cycles; FCEVs optimised for structured fleets with depot fuelling

- Regulatory momentum: EU CO₂ standards under review for 2027; UNECE GRPE defining test methods; UK policy clarity needed to unlock domestic opportunity

- Total cost of ownership competitive when hydrogen supply secured; retrofit and new-build pathways accelerate deployment across heavy-duty and off-highway sectors

Related: EV & Hydrogen in 2025: Slowdowns and What’s Next

1. What Is a Hydrogen Internal Combustion Engine?

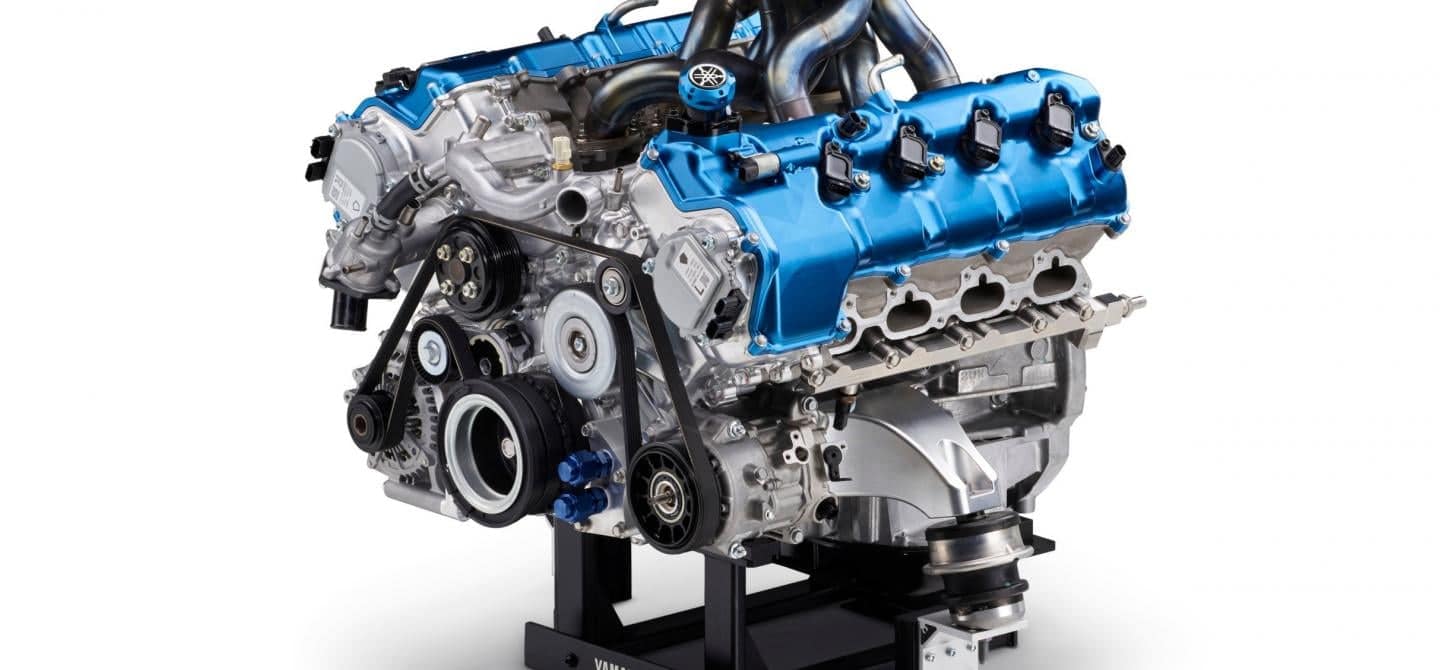

1.1 Operating Principles

A hydrogen internal combustion engine works by burning hydrogen gas in a modified spark-ignition or compression-ignition platform, converting chemical energy directly into shaft power through mechanical combustion. Unlike fuel-cell systems that convert hydrogen electrochemically to electricity before powering a motor, H2ICE engines operate through a combustion process fundamentally similar to conventional petrol or diesel engines, but with hydrogen as the fuel vector.

The core principle remains unchanged from Otto-cycle or Diesel-cycle engines: hydrogen and air mix during the intake and/or compression stroke, ignition occurs (via spark plug or pilot injection), the resulting expansion drives the piston, and exhaust gases exit the cylinder. The exhaust is dominated by water vapour (H₂O), with minimal CO₂. However, the high combustion temperature creates conditions for small amounts of nitrogen oxides (NOx) to form—a challenge that advanced combustion strategies and aftertreatment systems now address effectively.

1.2 Key Distinctions: H2ICE vs Other Hydrogen Powertrains

Understanding how H2ICE differs from competing hydrogen pathways is essential for appropriate application matching:

| Factor | H2ICE (Spark-Ignition) | H2ICE (HPDI) | FCEV (Fuel Cell) |

|---|---|---|---|

| Power path | Combustion → shaft power | High-pressure direct injection → shaft power | Electrochemistry → electric motor |

| System efficiency | 20–30% (optimised >40%) | 50%+ BTE potential | 40–60% |

| Manufacturing pathway | Reuse diesel/petrol lines | Specialist injection; shared gaseous fuel systems | New stack/balance-of-plant supply chains |

| Best application fit | NRMM, rapid deployment, high transient demand | Heavy-duty, long-haul, high efficiency priority | Structured fleets, depot refuelling, range-critical |

| Infrastructure requirement | Gaseous hydrogen storage (350–700 bar) | Gaseous hydrogen, high-pressure injection | Gaseous/liquid hydrogen stations with compression |

| Durability legacy | 130 years of ICE refinement | Proven combustion platforms + injection innovation | Growing but newer technology stack |

1.3 Hydrogen Fuel Properties Relevant to Engine Design

Hydrogen possesses unique thermochemical properties that both enable and constrain H2ICE design:

Energy density and performance:

- Gravimetric energy density: ~120 MJ/kg (nearly 3× diesel’s 45 MJ/kg)

- Volumetric energy density: ~11 MJ/m³ at STP (0.27× diesel), requiring high-pressure storage (350–700 bar gas or cryogenic liquid)

- Stoichiometric ratio: 0.0296 kg H₂/kg air (vs 0.0676 for diesel), enabling lean-burn operation with excess air

Combustion characteristics:

- Autoignition temperature: ~585°C (comparable to methane; ~400°C for diesel)

- Flammability range: 4–75% concentration in air (vs 0.6–5.2% for petrol), accommodating both lean and rich mixtures

- Laminar flame speed: ~3 m/s at stoichiometric (2.5–3.5× faster than methane or petrol), enabling rapid combustion

- Minimum ignition energy: <0.02 mJ (extremely low; 0.25 mJ for petrol), making pre-ignition and knock a design challenge

Handling and storage:

- Dispersal: Hydrogen rapidly diffuses in air; well-ventilated environments mitigate accumulation

- Embrittlement: High-pressure storage and fuel systems require specialised metallurgy and sealing

- Cryogenic storage: Liquid hydrogen (-253°C) offers 50× volumetric density gain but requires insulation and boil-off management

2. H2ICE vs Fuel-Cell Electric Vehicles: A Nuanced Comparison

While both H2ICE and FCEV pathways utilise hydrogen, they serve distinct market niches. Rather than competitors, they should be viewed as complementary technologies, each optimised for different operating profiles.

2.1 Technical Efficiency Comparison

Fuel-cell systems achieve 40–60% well-to-wheel efficiency by converting hydrogen to electricity via a proton-exchange membrane (PEM) stack, which then drives a high-efficiency electric motor. The electrochemical pathway avoids combustion losses and scales well with load.

H2ICE systems traditionally achieved 20–30% efficiency due to inherent Otto/Diesel-cycle limitations. However, recent advances—particularly high-pressure direct injection (HPDI) pioneered by Westport Innovations—now demonstrate 50%+ brake thermal efficiency (BTE). A collaborative demonstrator project involving AVL, TUPY, Westport, and ITnA (TU-Graz) achieved 50.1% BTE on a 13-litre heavy-duty hydrogen engine, with simulation-backed estimates suggesting 51.7% with further optimisation (compression ratio 23.1, high-efficiency fixed-geometry turbocharger). At full load, this HPDI engine ran at 97.5% hydrogen energy ratio with only a small liquid pilot injection.

Key insight: Once optimised for direct injection and lean combustion, H2ICE efficiency rivals or exceeds diesel, closing the gap with fuel cells and dramatically improving total cost of ownership (TCO) for heavy-duty applications.

2.2 Manufacturing and Supply-Chain Reuse

H2ICE advantages:

- Reuses existing cylinder heads, blocks, cranks, gearboxes, and axles from mature diesel platforms

- Minimal retooling of engine production lines

- Service networks already trained in ICE diagnosis and repair

- Existing fastener, seal, and component supply chains remain leverageable

FCEV requirements:

- Bespoke stack manufacturing (fuel cell stack, hydrogen regulator, humidifier, cooling systems)

- New balance-of-plant (BOP) suppliers (power electronics, high-voltage connectors, thermal management)

- New maintenance protocols for electrochemical systems

- Technician retraining on fuel-cell diagnostics

Economic implication: H2ICE capital expenditure for vehicle manufacturers is lower, and market entry is faster. The UK Advanced Propulsion Centre (APC) Task & Finish Group emphasises this as the least inflationary path to NRMM decarbonisation, with H2ICE-powered equipment capital costs “within the scope of normal price inflation/improved product development changes.”

2.3 Application-Fit Analysis

H2ICE is optimal for:

- Off-highway/non-road mobile machinery (NRMM): Construction equipment, agricultural machinery, forestry, mining, generators

- Rapid transient response: Machines requiring instant torque response (e.g. excavator bucket lifting); ICE combustion provides direct mechanical coupling

- Harsh, remote environments: Rugged reliability in dust, mud, extreme temperatures; no sensitive electronics or clean-air requirements

- High utilisation, fuel-delivery logistics: Machines where refuelling happens via mobile fuel tankers (‘bowsers’) to site; not feasible to move machine to distant refuelling stations

- Retrofit economics: Existing diesel platforms can be converted to H2ICE with minimal chassis/driveline modification

FCEV is optimal for:

- Structured, return-to-base operations: Urban buses, postal fleets, refuse collection

- Long-haul, steady-state duty: Where efficiency and range per refuelling matter most

- Clean-air environments: Cities and developed infrastructure with emerging fuel-cell stations

- Driver preference for quietness: Fuel cells are silent; combustion engines produce noise

Complementarity example: A UK construction site uses a hydrogen fuel-cell excavator for on-site power generation (return-to-base) and a hydrogen-combustion backhoe loader for mobile, remote work. Both serve decarbonisation; each optimised for its duty cycle.

3. Technical Deep Dive: Combustion Strategies and Efficiency

3.1 Spark-Ignition Lean-Burn Approach

The spark-ignition H2ICE uses a port-fuel or direct-injection (DI) system to introduce hydrogen gas into the cylinder during intake or early compression. By operating at high air-to-fuel ratios (λ > 1.3), the engine runs lean—excess oxygen is present beyond what combustion requires. This lean regime has multiple benefits:

- Lower peak temperature: Reduced combustion temperature suppresses NOx formation (NOx rises exponentially above ~1800 K)

- Improved efficiency: Lean combustion reduces heat loss to walls and improves specific heat ratio

- Throttling reduction: Unlike stoichiometric petrol engines, lean H2ICE can operate at part-load with minimal throttling losses

Challenges of lean burn:

- Ignition stability: At very high air ratios, flame propagation slows and misfire risk increases

- Backfire tendency: Hydrogen’s low minimum ignition energy can cause combustion to occur in the intake manifold if intake valve overlap is excessive

- Catalyst light-off: NOx aftertreatment (SCR) requires adequate exhaust temperature

3.2 High-Pressure Direct Injection (HPDI) Pilot-Ignition Strategy

The HPDI approach, championed by Westport Innovations and demonstrated by AVL/TUPY, injects hydrogen directly into the combustion chamber at very high pressure (200–350 bar) near the end of the compression stroke. A small quantity of conventional liquid fuel (typically diesel, ~2–5% by energy content) serves as a pilot ignition source, ensuring robust auto-ignition of the hydrogen charge.

Advantages of HPDI:

- Brake thermal efficiency >50%: Late-cycle injection means expansion work from hydrogen combustion is captured; minimal pilot fuel reduces its combustion loss

- Transient response: Precise fuel injection enables rapid torque control

- Robust combustion: Pilot injection ensures ignition under all operating conditions, eliminating misfire risk

- CO₂ compliance: With 97.5% hydrogen energy content at full load, HPDI engines can meet stringent CO₂ limits (e.g. 3 g CO₂/tonne·km for heavy-haul trucks)

Trade-offs:

- Complex fuel system: Requires high-pressure hydrogen pumping, dual fuel rails, specialized injectors

- Pilot fuel supply: Logistics and sustainability require that pilot diesel is either minimized or sourced from renewable e-fuels

- Supplier ecosystem: Fewer suppliers (Westport, AVL, others) have HPDI expertise; ramp-up is slower than spark-ignition retrofit

Current status: AVL’s 50.1% BTE achievement positions HPDI as the efficiency pathway for new-build heavy-duty engines. Retrofit platforms favour spark-ignition due to simpler integration.

3.3 Compression Ratio and Turbocharging

Compression ratio: H2ICE engines typically operate at compression ratios (CR) of 11–17:1, approaching or matching diesel engines. Higher CR improves thermal efficiency but increases mechanical stress and peak pressure. The AVL/TUPY demonstrator ran at baseline 17.5:1; optimisation modelling suggested CR 23:1 (with reinforced structure) could reach 51.7% BTE.

Turbocharging/supercharging: To compensate for hydrogen’s low volumetric energy density and maintain power output relative to diesel equivalents, H2ICE engines typically use variable-geometry turbochargers (VGT) or fixed-displacement superchargers. VGT allows fine control of boost pressure across the load map, improving transient response and low-speed torque—critical for NRMM. Some designs employ both high-pressure EGR and VGT for additional efficiency gains.

3.4 Efficiency Benchmarking

Recent peer-reviewed studies and manufacturer data reveal:

- Spark-ignition PFI, optimised: 40–42% BTE in steady-state; up to 38% in transient NRTC (Non-Road Transient Cycle)

- HPDI with pilot ignition: 50–51% BTE demonstrated; potential path to 52% with further optimisation

- Comparison to diesel: Modern Stage V diesel engines achieve 45–47% BTE; optimised H2ICE now matches or exceeds this

- Comparison to FCEV: Tank-to-wheel, FCEV systems are typically 35–45% efficient (fuel cell 50–60% × motor 90%, minus accessory loads); H2ICE’s lower wall-plug efficiency is offset by simpler powertrain

Bottom line: Fears that H2ICE efficiency would lag diesel have been disproven by recent hardware demonstrations. The technology pathway to 50%+ efficiency is now proven.

4. Emissions Performance: CO₂ and NOx

4.1 CO₂ Emissions (Tank-to-Wheel)

When burning green hydrogen (from renewable-powered electrolysis or biomass-derived sources), H2ICE engines eliminate tailpipe CO₂ entirely. The exhaust is dominated by water vapour (H₂O), which is non-toxic and non-persistent.

Lifecycle implications:

- Tailpipe: 0 g CO₂/km (vs. Stage V diesel: ~0.7 g CO₂/km for heavy trucks)

- Well-to-tank: Depends on hydrogen production pathway:

- Green hydrogen (renewable electrolysis): ~0 g CO₂/MJ (when powered by wind/solar)

- Grey hydrogen (steam methane reforming without CCS): ~90 g CO₂/MJ

- Blue hydrogen (SMR + CCS): ~10–15 g CO₂/MJ

- Lifecycle (tank-to-wheel + well-to-tank): With green hydrogen, <1 g CO₂/km; with blue hydrogen, ~15–20 g CO₂/km (still ~95% lower than diesel)

Policy relevance: The AVL/TUPY HPDI engine achieves <3 g CO₂/tonne·km, meeting potential EU CO₂ limits for heavy-duty transport by 2035–2040. The UK APC Task & Finish Group documents that H2ICE engines deliver 99.95% CO₂ reduction compared to Stage V diesel.

4.2 NOx Emissions: Formation and Control

NOx (nitrogen monoxide, NO, and nitrogen dioxide, NO₂) forms when combustion temperature exceeds ~1800 K, causing nitrogen in the combustion air to oxidise. While H2ICE eliminates CO₂, NOx control is the technical focus.

4.2.1 Combustion-Based NOx Reduction

Lean-burn strategy:

- Operation at λ (air ratio) > 1.3 (more air than stoichiometric) reduces peak temperature

- Excess oxygen slows flame propagation, further lowering temperature spikes

- Result: NOx formation is minimised at source

Exhaust Gas Recirculation (EGR):

- A portion of cooled exhaust gas is reintroduced to the combustion chamber, displacing some fresh oxygen and lowering peak temperature

- High-pressure EGR (HP-EGR) feeds cooled exhaust upstream of the turbocharger compressor, enhancing effectiveness

- Trade-off: EGR increases combustion stability challenges and can reduce efficiency if not carefully controlled

Direct Injection (DI):

- Late-cycle DI places hydrogen charge closer to ignition, shortening the time at peak temperature

- HPDI further refines this, allowing stratification (rich zones near spark plug, lean zones in bulk gas) for improved ignition stability

4.2.2 Aftertreatment: Selective Catalytic Reduction (SCR)

For applications where combustion-based NOx reduction alone is insufficient, selective catalytic reduction (SCR) systems inject urea (AdBlue) into the hot exhaust stream. A catalyst (typically vanadium or zeolite-based) converts NO and NO₂ to N₂ and H₂O. SCR is mature technology, widely deployed on diesel trucks and buses.

Key metrics:

- JCB H2ICE (Stage V certified): 0.020 g NOx/kWh on NRTC cycle (current Stage V limit: 0.4 g/kWh; 98% reduction)

- Cummins X15H engine: NOx performance data forthcoming; expected in similar range given similar lean-burn + SCR architecture

- MAN hTGX truck: Meets Euro 7 early proposals (target <90% NOx reduction vs. Stage V)

4.3 Particulate Matter (PM) and Air Quality

One of H2ICE’s environmental co-benefits is near-elimination of particulate matter:

- Spark-ignition H2ICE (no pilot fuel): Negligible PM (<0.01 mg/m³), as hydrogen combustion produces no soot precursors

- HPDI H2ICE (small pilot fuel): PM typically <0.05 mg/m³, approaching stoichiometric hydrogen levels

- Stage V diesel: Regulated limit 0.010 g/kWh PM; real-world emissions ~0.005–0.015 mg/m³

Health impact: The UK APC Task & Finish Group estimates £150–505 million per year in environmental and healthcare cost savings across the NRMM sector if H2ICE adoption accelerates, primarily from avoided PM-related respiratory disease and PM-linked cardiovascular mortality.

6. Leading Manufacturers and Market Status

JCB Hydrogen Engines

JCB (J.C. Bamford Excavators Ltd.), UK-based manufacturer of construction and agricultural equipment, is a pioneer in H2ICE commercialisation:

- 448 4-cylinder engine: 4.8-litre displacement, 55 kW net output, spark-ignition PFI system with port-fuel injection

- EU type approval: First full Stage V type-approval achieved in 2025 across 10 European countries (Germany, France, Netherlands, etc.)

- Emissions performance: NOx <0.02 g/kWh (NRTC), PM negligible, CO₂ zero (with green H₂)

- Retrofit-ready: Designed for integration into existing JCB backhoe loaders and small-frame excavators

- Deployment: Machines with JCB H2ICE entering pilot operations with European construction contractors in 2025–2026

Cummins X15H and X12H Engines

Cummins, the US heavy-duty engine manufacturer, unveiled hydrogen variants at the 2024 IAA Transport Show in Hannover:

- X15H hydrogen engine: 15-litre displacement; 400–530 horsepower; ~2,600 Nm peak torque

- X12H engine: Smaller variant for mid-range trucks and buses

- Fuel system: Spark-ignition with port fuel injection; designed for 350 bar gaseous hydrogen storage

- Applications: Heavy-duty trucks, intercity coaches, dump trucks

- Production timeline: Small series planned 2025–2026; joint venture with Tata Motors (India) for manufacturing

- Efficiency: Targeting >40% BTE; full NOx data to be released

MAN hTGX Hydrogen Truck

MAN Truck & Bus (Germany) is advancing a hydrogen derivative of its best-selling TGX platform:

- MAN hTGX: Based on proven TGX chassis; spark-ignition H2ICE engine

- Performance: Range ~600 km; <1 g CO₂/tonne·km; refuelling <15 minutes

- Market introduction: Small series production 200 units in 2025; European sales to selected fleets

- Trial deployment: Van der Vlist (Dutch transport operator) planning three hTGX trucks for early-2026 deployment

- Award recognition: MAN hTGX won the 2025 Truck Innovation Award

- Cost trajectory: TCO parity with diesel projected for 2027–2028 if hydrogen costs decline to €5–7/kg

Toyota GR Corolla – Liquid Hydrogen

Toyota has pioneered liquid hydrogen (LH₂) propulsion for motorsport, proving H2ICE viability at high performance:

- GR Corolla H2 racing prototype: 2.0-litre engine, ~552 horsepower, 9,000 rpm

- Fuel system: Cryogenic liquid hydrogen (-253°C) stored in insulated tanks; reduces tank volume vs. 700 bar gas

- Races: Super Taikyu Fuji 24-Hour Race (2024, 2025), demonstrating 24-hour endurance capability

- Innovation: Developed bespoke fuel injectors, valve materials, and engine management to handle LH₂ thermal extremes

8. Cost Analysis and Total Cost of Ownership (TCO)

8.1 Capital Expenditure (CapEx) Comparison

Heavy-duty truck baseline (2025):

- Stage V diesel truck: €120,000–150,000

- H2ICE truck (MAN hTGX equivalent): €150,000–190,000 (+25–30% premium)

- FCEV truck (Hyundai Nexo or equivalent): €200,000–280,000 (+67–87% premium)

- BEV truck (limited range options): €180,000–350,000 (+50–133% premium)

8.3 Total Cost of Ownership (TCO) Scenario

5-year fleet TCO for a 40-tonne truck (long-haul, 150,000 km/year):

| Cost Category | Diesel (Stage V) | H2ICE (40% BTE) | H2ICE (50% BTE) | FCEV |

|---|---|---|---|---|

| Vehicle purchase | €150,000 | €175,000 | €175,000 | €250,000 |

| Financing (5 yr @ 5%) | €32,500 | €38,000 | €38,000 | €54,000 |

| Fuel (750,000 km) | €300,000 | €240,000 | €160,000 | €180,000 |

| Maintenance | €60,000 | €67,500 | €67,500 | €75,000 |

| Insurance, registration | €35,000 | €35,000 | €35,000 | €45,000 |

| Total 5-year TCO | €577,500 | €555,500 | €475,500 | €604,000 |

| TCO/km | €0.77 | €0.74 | €0.63 | €0.81 |

Key insights:

- H2ICE (40% BTE) breakeven: Slight advantage vs. diesel even at current hydrogen prices (€2.50/kg); advantage widens if H₂ cost falls to €2.00/kg

- H2ICE (50% BTE) clear winner: TCO advantage of ~€100/km (13% reduction) over diesel and ~€0.18/km vs. FCEV

- Sensitivity: TCO swing ±€30,000 per €1.00/kg change in hydrogen cost; policy-driven H₂ subsidies (grant programs, tax breaks) accelerate payback

10. Infrastructure Readiness: Hydrogen Refuelling Stations

10.1 Global Hydrogen Station Landscape (2025)

Current deployment:

- Total public stations worldwide: ~800 (2024); ~250 in Europe, ~200 in Japan/S. Korea, ~100 in California

- Europe concentration: Germany (85 stations), France (72), Scandinavia (47)

- UK status: 5 operational stations (London, Reading, others); TfL planning network expansion with Transport for London and Shell partnership

See current station availability at H2.LIVE.

10.2 AFIR Corridor Development and Timeline

EU AFIR mandate (2031 target):

- Stations every 200 km on TEN-T corridors (major EU transport routes)

- Estimated station density needed: 400–500 additional public stations by 2031

- Current funding: €700M+ EU co-financing + member-state matching

- Project pipeline: 150+ new stations in development across Germany, France, Benelux, Scandinavia, Italy, Spain (2025–2028)

11. Market Forecast and Growth Trajectory

11.1 Production Volumes and Market Adoption Timeline

Analyst projections (2025–2035):

| Year | Global H2ICE Units (all types) | Heavy-duty trucks | NRMM equipment | Gensets & other |

|---|---|---|---|---|

| 2025 | ~2,000 | 500 | 1,200 | 300 |

| 2027 | ~15,000 | 4,000 | 8,500 | 2,500 |

| 2030 | ~80,000 | 25,000 | 40,000 | 15,000 |

| 2035 | ~250,000 | 100,000 | 120,000 | 30,000 |

Regional variation:

- Europe: Fastest adoption; regulatory support, AFIR infrastructure, strong OEM commitment; 40–50% of global volume 2030

- North America: Adoption contingent on US policy clarity (EPA vs. CARB); 20–30% of global volume 2030 if policy favourable

- Asia-Pacific: China, Japan, S. Korea investing heavily; 25–35% of global 2030 volume

- Rest of World: Slower; limited hydrogen infrastructure and regulatory incentives; 5–10% of volume

14. Future Outlook and Vision 2035

14.3 Vision Statement: 2035 Balanced Decarbonisation Portfolio

By 2035, the global heavy-duty transport and NRMM sectors will employ a balanced portfolio of powertrains, each optimised for its duty cycle:

- Battery-Electric Vehicles (BEV): 40–50% of heavy-duty sales; ideal for urban delivery, short-haul, fixed-route buses; cost-competitive, zero-tailpipe-emission, low-noise

- Hydrogen Fuel-Cell Vehicles (FCEV): 20–25% of heavy-duty sales; long-haul, intercity, clean-air environments; high efficiency, long range, rapid refuelling

- Hydrogen Internal Combustion Engines (H2ICE): 15–20% of heavy-duty; rugged NRMM, high-utilisation operators, regions with depot-based fuelling; robust, retrofit-friendly, cost-competitive

- Sustainable ICE (e-fuels, synthetic fuels): 5–10% of heavy-duty; specialised applications, legacy vehicle continued use; bridge technology during transition

15. Conclusion

The hydrogen internal combustion engine has graduated from laboratory curiosity to commercial reality. With JCB securing EU type approval, Cummins ramping production of the X15H engine, MAN bringing 200 hTGX trucks to market in 2025, and HD Hyundai Infracore targeting early mass production, H2ICE is transitioning from prototype to fleet deployment within 12 months.

Technical achievements have validated early doubts: optimised H2ICE engines now exceed 50% brake thermal efficiency, rival diesel on fuel economy, and deliver near-zero tailpipe NOx and PM. CO₂ emissions are eliminated entirely when burning green hydrogen. The manufacturing pathway is proven—retrofit existing platforms or develop new-build HPDI architectures, both viable routes to market.

Yet H2ICE’s success depends on resolving five critical factors:

- Hydrogen supply and cost: Must reach €2.00–2.50/kg by 2027–2028 and be predominantly green (renewable or CCS-captured sources)

- Infrastructure: AFIR corridor stations and private on-site refuelling must proliferate to 500+ public + 100+ private hubs by 2030

- Regulatory alignment: EU Euro 7, UK policy, and US EPA/CARB must adopt lifecycle emission accounting that credits green hydrogen pathways

- OEM commitment: Volume production scaled beyond 50,000 units/year; cost learning curves must kick in

- Supply-chain maturity: H2ICE-specific lubricants, fuel systems, aftertreatment components must reach wide availability and standardisation by 2026–2027

The market opportunity is substantial. NRMM alone—construction, agriculture, power generation—represents a £17.6 billion UK sector and 100,000+ jobs. Heavy-duty trucks globally represent a multi-billion-euro annual market. Early-adopter nations and OEMs will capture disproportionate value; late movers risk margin compression and export disadvantage.

For operators, H2ICE offers a pragmatic, cost-effective decarbonisation pathway where BEV and FCEV face barriers—rugged duty, remote operation, rapid transient response, existing ICE supply-chain leverage. For manufacturers, H2ICE is a complementary, not competitive technology alongside FCEV and BEV, enabling a balanced portfolio that meets diverse customer needs and regulatory targets.

Embedded References and Further Reading

Regulatory and Policy Documents:

- UK Advanced Propulsion Centre H2ICE Task & Finish Group Report (Oct 2024)

- H2Accelerate Hydrogen ICE Paper (Oct 2025)

- Clean Hydrogen Partnership Observatory

Technical References:

- AVL Commercial Hydrogen Engine 50% BTE

- Infineum H2ICE Lubrication

- RSC Energy & Environmental Science (2025) Low-NOx H2ICE for Off-Road Applications

Manufacturer and Industry Resources:

- JCB Hydrogen Programme

- Cummins Hydrogen Engines

- MAN Truck & Bus Zero-Emission Portfolio

- HD Hyundai Infracore Hydrogen

- ULEMCo Hydrogen Retrofit

- Toyota Liquid Hydrogen Racing

Market and Infrastructure:

Pingback: Hydrogen Heavy Goods Transport: Fuel Cell, Hydrogen Combustion, and Dual-Fuel Pathways for 2025 %pagHydrogen Heavy Goods Transport in 2025 | Fuel Cell, H2ICE & Dual-Fuel Options

Pingback: Top European Hydrogen Truck Manufacturers 2025 | Ultimate FCEV & H2ICE Guide

Pingback: Hydrogen or Double the Trucks | Hydrogen HGV Decarbonisation UK