Hydrogen vs Battery-Electric by 2030: Sector-by-Sector Reality Check

The “hydrogen vs battery electric” debate isn’t a cage match — it’s allocation. By 2030, batteries dominate where efficiency and infrastructure win; hydrogen takes the hard yards where energy density and process chemistry are non-negotiable.

- Green hydrogen costs are falling but remain challenged by efficiency and distribution economics.

- Battery-electric leads market share and competitiveness for most transport and low-temperature industrial sectors.

- Hydrogen is essential for decarbonising heavy industries, shipping, aviation (as SAF), and high-temperature processes — see Green Steel.

- Effective decarbonisation will be a blend, not a battle, with each technology finding success in distinct niches.

The Economic Case for Hydrogen: Optimism and Cost Reduction Projections

Proponents of green hydrogen point to dramatic cost reductions already achieved and project continued steep declines through 2030. The International Renewable Energy Agency forecasts that electrolyzer system costs could fall by 60% by 2030 through manufacturing scale, learning rates, technological improvements, and increased module size. Recent research from Harvard Business School predicts clean hydrogen production costs will approach $1.60-$1.90 per kilogram by 2030, down from $3-5 today, bringing the industry closer to the U.S. Department of Energy’s ambitious $1/kg target.

Several factors underpin this optimistic outlook. First, renewable electricity costs—which comprise 70-90% of green hydrogen production expenses—continue to fall faster than previously anticipated. Second, electrolyzer manufacturers have announced capacity scale-ups totaling over 3 GW per year, accelerating cost roadmaps with projections showing system costs hitting $480-620/kW by 2025 and $230-380/kW by 2030. Third, learning curve analysis demonstrates that for every doubling of deployment, costs fall by consistent percentages, with alkaline electrolyzers showing learning rates of 3-16% depending on electricity prices and load factors.

The global green hydrogen market reached $1.69 billion in 2024 and is projected to grow to $62.6 billion by 2033 at a remarkable 46.93% compound annual growth rate. Current prices vary significantly by region: $3,865/MT in the USA, $4,915/MT in Japan, $5,352/MT in the Netherlands, and $6,260/MT in the UAE as of Q2 2025. Government incentives, particularly the U.S. Inflation Reduction Act offering up to $3/kg in tax credits, can bring levelized costs below $2/kg in favorable conditions.

Industry leaders argue that hydrogen will play an essential role in sectors where direct electrification proves technically challenging or prohibitively expensive, including steel production, long-distance shipping, aviation fuel production, and high-temperature industrial heat. The International Energy Agency reports that novel applications in heavy industry and long-distance transport will account for one-third of global hydrogen demand by 2030 in net-zero scenarios.

The Critics’ Counterargument: Fundamental Economic and Physical Constraints

Critics present a compelling counter-narrative grounded in thermodynamic realities and infrastructure economics. A groundbreaking Harvard study published in Joule demonstrates that at current and projected delivered costs, green hydrogen represents “a prohibitively expensive strategy to reduce emissions, often exceeding the costs of directly removing CO₂ from the atmosphere.” The research reveals that while production costs may decline, storage and distribution costs—which constitute the majority of the final price—will prevent hydrogen from becoming cost-competitive in many sectors.

The efficiency penalty represents a fundamental physical limitation. Producing hydrogen via electrolysis loses 20-30% of energy, compression and storage lose another 10%, and converting hydrogen back to electricity through fuel cells loses an additional 30%, leaving only 30-40% of the original energy. By contrast, batteries achieve 85-95% round-trip efficiency. This three-fold difference in energy requirements means green hydrogen demands three times more wind turbines, solar panels, or nuclear power stations than direct electrification.

Real-world examples illustrate the scale of the challenge. In Southern California, hydrogen at the handful of refueling stations costs the equivalent of $16 per gallon of gasoline—ten times the production cost—with storage and distribution comprising most of that price. Harvard researchers argue that even if electrolyzer costs fall dramatically, they constitute less than 15% of total production costs when electricity prices are considered, meaning capital cost reductions provide limited overall relief.

The Manhattan Institute argues the $1/kg hydrogen production target is “unrealistic, even assuming large gains in electrolyzer efficiency.” Their analysis demonstrates that producing hydrogen at costs competitive with natural gas would require wholesale electricity prices to fall to $2.36/kg or $59/MMBtu—far beyond any realistic scenario. Even at historically high natural gas prices ($8.86/MMBtu in 2008), the avoided CO₂ cost for green hydrogen would be $305 per metric ton, well above current carbon pricing mechanisms.

Infrastructure requirements compound the economic challenges. Hydrogen production, storage, and distribution infrastructure requires massive upfront investment with uncertain returns. The U.S. will need approximately 1,750 hydrogen stations by 2035 requiring $5.2 billion in cumulative investment just for station installation, and this excludes pipeline networks, production facilities, and safety systems. Battery-electric vehicle charging infrastructure, while requiring substantial investment (estimated 674 TWh of annual electricity demand by 2035), can leverage existing electrical grids and benefit from exponentially faster deployment curves.

Where Both Technologies Stand Today: Development and Deployment Status

Battery-Electric Technology: Rapid Maturation and Market Dominance

The global electric vehicle market reached $1.33 trillion in 2024 and is projected to reach $6.52 trillion by 2030, growing at 32.5% annually. Battery costs have plummeted 99% over the past 30 years while energy density has increased fivefold, with costs falling 19% for every doubling of deployment. The “battery domino effect” has successively tipped consumer electronics, two-wheelers, cars, and is now poised to transform trucks and stationary storage.

In 2024, EV battery demand hit the 1 TWh mark, with battery demand for electric trucks growing 75%. Battery pack prices have dropped dramatically, falling 20% in 2024 compared to 2023, with Chinese manufacturers achieving nearly 30% reductions. Projections indicate utility-scale battery storage costs will fall 47% by 2030 and 67% by 2050 in optimistic scenarios, reaching $245/kWh by 2030 and $159/kWh by 2050.

Critically, announced global battery production capacity significantly exceeds projected demand through 2030, with China commanding 84% of global capacity in 2023 and 67% projected for 2030. North American capacity could meet 103% of domestic demand in 2030 for highly probable projects, while the EU could meet 72-99% depending on project realization. The technology has moved beyond cars: over 15,000 medium- and heavy-duty electric vehicles deployed in America in 2024 alone, including battery-electric semitrucks, passenger buses, and delivery vans.

Hydrogen Technology: Pilot Projects and Limited Commercialization

Less than 1% of global annual hydrogen production is green hydrogen produced via electrolysis. While several manufacturers have developed hydrogen fuel cell vehicles—Toyota’s third-generation fuel cell system, Hyundai’s Nexo with 500-mile range, BMW’s iX5 Hydrogen pilot fleet—these represent small-scale demonstrations rather than mass production.

Global hydrogen refueling stations surpassed 3,000 by the end of 2024, with notable concentrations in South Korea, California, and Europe. However, this pales compared to the hundreds of thousands of electric charging stations globally. Hydrogen infrastructure remains sparse, expensive, and concentrated in limited geographic areas, creating a classic chicken-and-egg problem where insufficient infrastructure prevents adoption while low adoption prevents infrastructure investment.

Industrial hydrogen applications show more promise. Several steel companies have initiated pilot projects using hydrogen in Direct Reduced Iron (DRI) processes, with Swedish steelmaker SSAB producing the first hydrogen-based steel in 2018. However, these remain small-scale demonstrations, with hydrogen-based steel approximately twice as expensive as coal-based steel due to energy-intensive hydrogen production. The chemical industry already uses hydrogen for ammonia and methanol production, providing a ready market for transitioning from gray to green hydrogen, though technical and economic barriers remain substantial.

Transport Sector: Electric Dominance with Hydrogen Niches

Road Transport: Battery-Electric Vehicles Lead in the hydrogen vs battery electric debate

For passenger vehicles, the technology trajectory strongly favors battery-electric solutions. Electric vehicles dominate with mature technology, extensive charging infrastructure, and favorable economics. Studies demonstrate that electrification is 30% more energy efficient than hydrogen in the passenger transport sector and five to six times more efficient in residential applications. Total cost of ownership analyses consistently show battery-electric vehicles outperforming hydrogen fuel cell vehicles for passenger cars, light commercial vehicles, and urban buses under most scenarios.

The efficiency advantage translates directly to infrastructure requirements. Cambridge professor David Cebon notes that “to run a truck on green hydrogen, you need about three times more electricity than you need to power a battery-electric vehicle. Three times more electricity means you need three times more wind turbines, three times more solar panels.” Combined with hydrogen fuel cell trucks costing approximately double the capital cost of battery-electric trucks—because they include all the battery-electric components plus fuel cells, hydrogen tanks, and delivery equipment—the economic case for hydrogen in light-duty transport remains weak.

However, nuances emerge in specific applications. For regional heavy-duty trucks with predictable routes and warehouse charging access, battery-electric solutions prove viable with charging during rest breaks. Yet for long-haul trucking exceeding 500-800 km daily with rapid turnaround requirements, hydrogen’s faster refueling (3-4 minutes versus 30+ minutes for batteries) and superior energy density provide genuine advantages. Total cost of ownership analyses for heavy-duty trucks show hydrogen fuel cell vehicles could achieve parity with diesel and battery-electric vehicles by 2030, particularly in long-haul applications — see my operator-level take in Hydrogen or Double the Trucks and the cost crossover in Zero-Emission HGV TCO.

Aviation and Shipping: Hydrogen’s Stronger Case

Aviation represents perhaps hydrogen’s most compelling application, though not as direct fuel but as feedstock for sustainable aviation fuels (SAF). Hydrogen produced via electrolysis combines with captured CO₂ through Power-to-Liquid (PtL) processes to create hydrocarbon fuels offering 95-98% reductions in net greenhouse gas emissions. First Movers Coalition members’ aviation commitments could require 0.1-0.2 million tonnes per annum of clean hydrogen by 2030. While direct hydrogen combustion in aircraft remains in early research phases, with Airbus targeting test flights by 2025, the extremely high energy density requirements of long-haul aviation (where batteries face fundamental weight limitations) position hydrogen-derived fuels as essential decarbonization tools.

Shipping similarly favors hydrogen-based solutions for deep-sea vessels. The maritime sector, responsible for nearly 3% of global greenhouse gas emissions, increasingly adopts e-fuels like e-methanol and e-ammonia—both requiring clean hydrogen as feedstock. Short-sea shipping may accommodate battery-electric propulsion for specific routes, but long-distance shipping’s range requirements and cargo weight constraints make hydrogen-based fuels more practical. First Movers Coalition commitments in shipping represent an estimated 0.3-0.5 million tonnes per annum of clean hydrogen demand by 2030.

Rail transport presents a mixed picture. Urban and regional trains can electrify using overhead lines or third rails, leveraging existing electrical infrastructure with high efficiency. However, for non-electrified routes where installing catenary systems proves economically unfeasible, hydrogen fuel cell trains offer zero-emission alternatives. Germany, the UK, Japan, and South Korea have introduced hydrogen fuel cell trains, with the U.S. developing switching locomotives in partnership with Sierra Northern Railway.

Industry Sector: Hydrogen’s Essential Role Emerges

Steel Production: Hydrogen as Game-Changer

Steel manufacturing represents hydrogen’s clearest industrial application. Traditional blast furnaces use coal-derived coke to reduce iron ore, producing approximately 1.85 tons of CO₂ per ton of steel. Direct Reduced Iron (DRI) using hydrogen replaces carbon with hydrogen as the reducing agent, producing water instead of CO₂. While hydrogen DRI can more than double production costs at current hydrogen prices, the process offers a technically proven pathway to near-zero emissions steel.

Major steel producers have initiated pilot projects: Sweden’s SSAB, H2 Green Steel, and Hybrit plants lead the transition. Hydrogen-based steel production will account for approximately 6 million tonnes of hydrogen demand by 2030, equivalent to about 90 million tonnes of green steel annually. This represents roughly 4% of total hydrogen demand in 2030 while driving nearly 20% of that year’s emissions reductions. A carbon cost of $50-100 per ton can make hydrogen-based steel production competitive in many locations given the significant emissions savings. See my explainer: Green Steel — how hydrogen changes the market.

Alternative approaches exist. Molten oxide electrolysis (MOE) uses electric currents to heat iron ore to 1,600°C, eliminating the need for hydrogen entirely. Boston Metal pursues this technology, which offers advantages for higher-value specialty metals. However, the infrastructure requirements and energy intensity suggest MOE will complement rather than replace hydrogen DRI for bulk steel production.

Chemicals and High-Temperature Industrial Heat

The chemical industry already consumes vast quantities of hydrogen for ammonia and methanol production, creating an existing market for transitioning from gray (fossil-based) to green hydrogen. In 2030, chemicals sector hydrogen demand could reach significant levels as traditional processes transition to renewable hydrogen feedstocks, though the complexity of chemical projects and large investment requirements mean the transition will be gradual.

High-temperature industrial processes (>1,000°C) in cement, glass, and ceramics production present applications where direct electrification faces technical limitations. Hydrogen combustion can generate the necessary temperatures while eliminating carbon emissions. However, these applications remain in early research and pilot phases, with commercial deployment unlikely before the late 2020s or early 2030s.

Low-Temperature Applications: Electrification Dominates

For industrial heat below 200°C and building heating, direct electrification demonstrates clear superiority. Heat pumps and electric heating systems achieve far higher energy efficiency than hydrogen systems, with lower capital and operating costs. The PIK Institute study found that across all scenarios, direct electrification dominates for low-temperature heating in buildings and industry, with hydrogen competing only in approximately 15% of final energy applications.

German industry demonstrates this balance: in an electrification-dominated scenario, electricity demand nearly doubles to 425 TWh by 2045 while hydrogen demand reaches 201 TWh (still essential for steel and chemicals). In a hydrogen-intensive scenario, hydrogen demand rises to 442 TWh but electricity demand still increases 40% to 300 TWh. Both pathways prove technically feasible, but cost analysis consistently favors electrification where technically possible.

Energy Storage and Grid Services: Battery Dominance with Limited Hydrogen Role

U.S. utility-scale battery deployments reached a record 4.9 GW and 15 GWh in Q2 2025, representing 63% year-over-year growth. Battery storage in stationary applications will grow from 2 GW in 2017 to approximately 175 GW by 2030, rivaling pumped hydro storage. Lithium-ion battery costs for stationary applications could fall below $200/kWh by 2030.

Batteries excel in short-duration storage (minutes to hours), providing frequency regulation, load shifting, and integration of variable renewable energy. Their high round-trip efficiency (80-90%) makes them economically viable for daily cycling applications that hydrogen storage (with 30-40% round-trip efficiency) cannot match.

Hydrogen’s potential role in grid storage focuses on long-duration, seasonal storage where batteries face economic and technical limits. For multi-day lulls in renewable generation, hydrogen could theoretically store summer solar energy for winter use. However, the economics remain challenging: the capital costs of electrolyzers, hydrogen storage, and fuel cells or hydrogen turbines for reconversion, combined with the low utilization rates inherent in seasonal storage, result in levelized costs far exceeding battery alternatives for durations under 100 hours.

Long-duration storage technologies beyond batteries are developing: compressed air, pumped hydro, flow batteries, and molten salt thermal storage all compete with hydrogen, each with distinct advantages for different duration and power requirements. Hydrogen storage will likely occupy a narrow niche for truly long-duration (weeks to months) storage rather than serving as a primary grid flexibility resource.

Opportunities Matrix for 2030: Technology-by-Sector Analysis

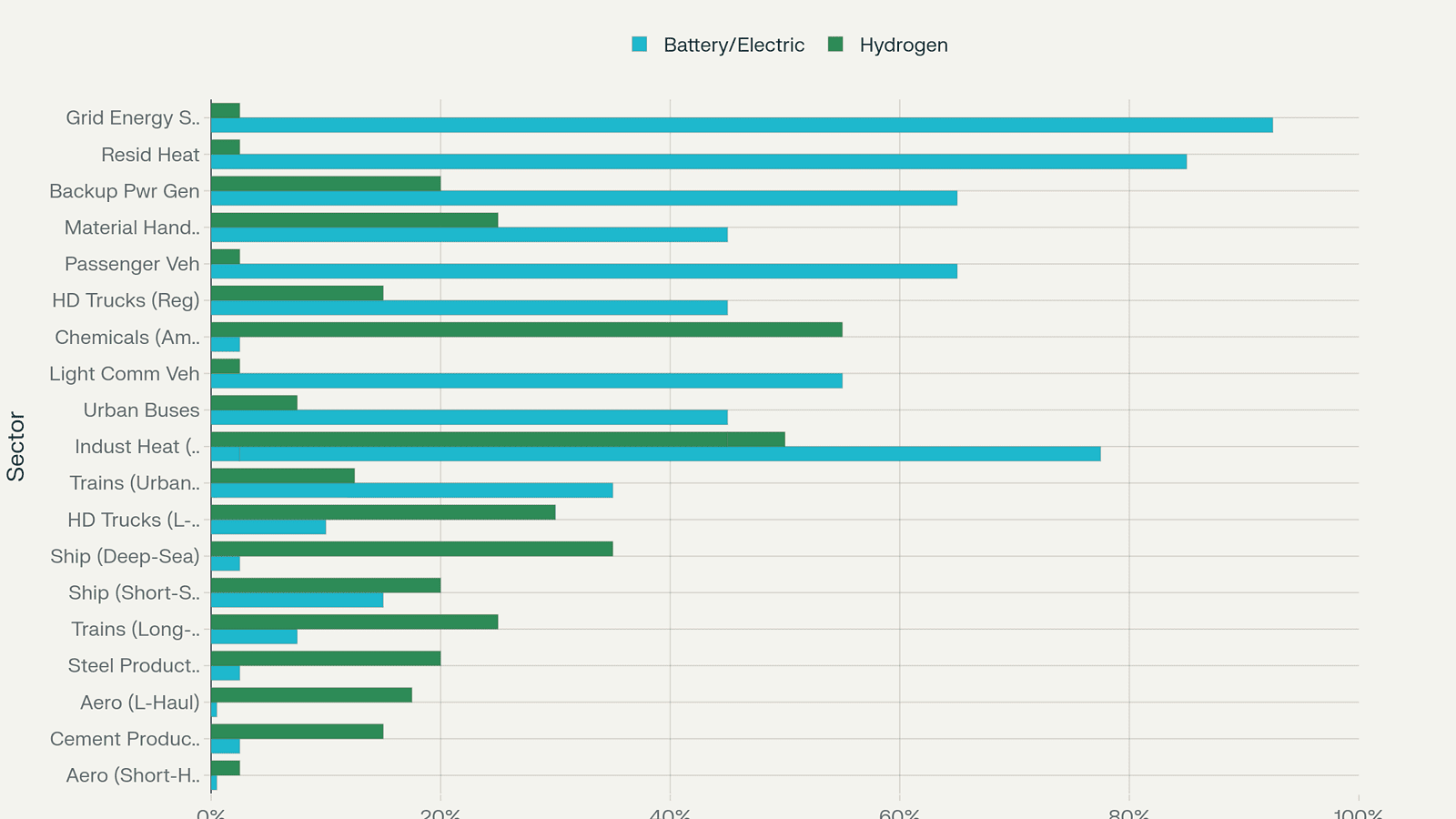

The comprehensive analysis reveals clear patterns in where each technology will compete effectively by 2030. The chart below displays projected market share for battery-electric versus hydrogen solutions across 20 key sectors. Several insights emerge from this systematic comparison.

Battery-electric technology dominates in sectors characterized by:

- Mature technology requiring proven, scalable solutions

- Applications where efficiency directly translates to cost savings

- Routes or use patterns with predictable energy needs

- Existing electrical infrastructure that can be adapted

- Daily cycling or frequent use patterns favoring high round-trip efficiency

These sectors include passenger vehicles (projected 60-70% electric market share by 2030), urban buses (40-50%), light commercial vehicles (50-60%), residential heating (80-90%), low-temperature industrial heat (70-80%), and grid energy storage (90-95%).

Hydrogen solutions prove most viable in sectors requiring:

- High energy density for weight-constrained applications

- Long range or duration beyond current battery capabilities

- High-temperature heat generation (>1,000°C)

- Hydrogen as chemical feedstock or reducing agent

- Rapid refueling to minimize operational downtime

These applications include chemicals production (50-60% hydrogen market share by 2030), high-temperature industrial heat (40-50%), steel production (15-25% initially, growing thereafter), deep-sea shipping (30-40%), and long-haul aviation fuel (15-20% as SAF).

| Sector/Application | Battery/Electric Viability | Hydrogen Viability | Tech Maturity (Battery) | Tech Maturity (Hydrogen) | Cost Competitiveness | Primary Advantage | Battery Market Share | Hydrogen Market Share |

|---|---|---|---|---|---|---|---|---|

| Passenger Vehicles | Dominant | Limited | Mature | Early | Battery | Efficiency, Cost, Infrastructure | 60-70% | <5% |

| Urban Buses | Dominant | Emerging | Mature | Pilot | Battery | Efficiency, Cost, Range adequate | 40-50% | 5-10% |

| Light Commercial Vehicles | Dominant | Limited | Mature | Early | Battery | Efficiency, Cost, Infrastructure | 50-60% | <5% |

| Heavy-Duty Trucks (Regional) | High | Medium | Developing | Pilot | Comparable | Efficiency, Infrastructure | 40-50% | 10-20% |

| Heavy-Duty Trucks (Long-Haul) | Medium | High | Early | Pilot | Comparable | Range, Refuel Speed | 5-15% | 25-35% |

| Trains (Urban/Regional) | High | Medium | Developing | Pilot | Battery | Efficiency, Infrastructure exists | 30-40% | 10-15% |

| Trains (Long-Distance) | Medium | High | Early | Pilot | Comparable | Range, Refuel Speed | 5-10% | 20-30% |

| Aviation (Short-Haul) | Limited | Medium (SAF) | Research | Research | Neither | Energy density needed | <1% | <5% (SAF) |

| Aviation (Long-Haul) | Not Viable | High (SAF) | Research | Pilot | Hydrogen | Energy density, Range | <1% | 15-20% (SAF) |

| Shipping (Short-Sea) | Emerging | Medium | Pilot | Pilot | Uncertain | Efficiency for short routes | 10-20% | 15-25% |

| Shipping (Deep-Sea) | Limited | High | Research | Pilot | Hydrogen | Energy density, Range | <5% | 30-40% |

| Residential Heating | Dominant | Limited | Mature | Early | Battery | Efficiency, Simple | 80-90% | <5% |

| Industrial Heat (Low Temp <200°C) | Dominant | Limited | Mature | Early | Battery | Efficiency, Temperatures achievable | 70-80% | <10% |

| Industrial Heat (High Temp >1000°C) | Not Viable | High | Not Applicable | Pilot | Hydrogen | High temp capability | <5% | 40-50% |

| Steel Production | Not Viable | High | Not Applicable | Pilot | Hydrogen | Essential for direct reduction | <5% | 15-25% |

| Cement Production | Limited | High | Research | Research | Uncertain | High heat generation | <5% | 10-20% |

| Chemicals (Ammonia/Methanol) | Not Viable | Dominant | Not Applicable | Developing | Hydrogen | Feedstock requirement | <5% | 50-60% |

| Grid Energy Storage | Dominant | Limited | Mature | Early | Battery | Round-trip efficiency | 90-95% | <5% |

| Backup Power Generation | High | Medium | Developing | Pilot | Comparable | Fast response | 60-70% | 15-25% |

| Material Handling (Forklifts) | High | Medium | Mature | Pilot | Comparable | Quick refuel vs Battery | 40-50% | 20-30% |

Competitive sectors where both technologies vie for market share include:

- Long-haul heavy-duty trucks (25-35% hydrogen, 5-15% battery)

- Long-distance trains (20-30% hydrogen, 5-10% battery)

- Regional heavy-duty trucks (10-20% hydrogen, 40-50% battery)

- Short-sea shipping (15-25% hydrogen, 10-20% battery)

- Backup power generation (15-25% hydrogen, 60-70% battery)

Synthesis: A Complementary Rather Than Competitive Future

The evidence suggests both hydrogen advocates and critics oversimplify a complex reality. Green hydrogen will not be the “Swiss army knife of decarbonization” that replaces electrification across all sectors. The fundamental efficiency disadvantage and high infrastructure costs make hydrogen economically unviable where direct electrification proves feasible. However, dismissing hydrogen entirely ignores genuine applications where no viable alternatives exist.

The cost debate resolves differently across applications. For sectors where hydrogen competes directly with battery-electric solutions (passenger vehicles, urban delivery, residential heating), batteries’ superior efficiency and rapidly declining costs make hydrogen uneconomic both today and in 2030. Critics are correct that green hydrogen will remain expensive relative to direct electrification in these applications.

For sectors requiring hydrogen as a chemical input (ammonia, methanol, steel reduction) or where extreme energy density proves essential (long-haul aviation, deep-sea shipping), hydrogen becomes not merely cost-competitive but necessary. In these applications, the relevant comparison is not hydrogen versus batteries but hydrogen versus continued fossil fuel use or no decarbonization at all. Here, advocates correctly identify hydrogen as an essential tool, with costs declining sufficiently by 2030 to enable meaningful deployment.

Infrastructure investment patterns must reflect this sectoral division. Approximately 80-90% of clean energy infrastructure investment should prioritize renewable electricity generation and battery-electric systems, supporting rapid electrification of passenger vehicles, light commercial transport, residential heating, and industrial processes amenable to direct electrification. The remaining 10-20% should fund hydrogen infrastructure in the specific sectors and applications where it proves essential, avoiding wasteful hydrogen development in sectors better served by electrification.

Policy Implications: Blending Pathways, Not Picking Sides

Policy implications flow directly from this analysis. Rather than choosing between hydrogen and electrification, policymakers should:

- Prioritize electrification as the primary decarbonization pathway, removing barriers to renewable power expansion, electric vehicle adoption, and heat pump deployment

- Target hydrogen support narrowly to no-regret sectors including steel, chemicals, sustainable aviation fuels, maritime shipping, and long-haul heavy transport — see my HGV piece

- Establish clear hydrogen certification standards ensuring only genuinely low-carbon hydrogen (green or blue with verified carbon capture) receives policy support

- Phase out hydrogen subsidies in sectors where electrification proves viable, avoiding market distortions that delay efficient solutions

- Invest in R&D for both technologies, recognizing that continued battery improvements may displace hydrogen in currently marginal applications while hydrogen cost reductions expand its viable application range

Explore more on

hydrogen infrastructure,

zero-emission freight, and

UK hydrogen policy.

References & Further Reading

- Harvard Business School – Could Clean Hydrogen Become Affordable at Scale by 2030?

- IRENA – Green Hydrogen: A Guide to Policy Making

- ICCT – The Price of Green Hydrogen

- IMARC – Green Hydrogen Price Index Q2 2025

- Harvard – Green Hydrogen Far Pricier Than Projected

- Harvard Salata Institute – Green Hydrogen: Too Costly to Have a Future?

- Manhattan Institute – Green Hydrogen: A Multibillion-Dollar Energy Boondoggle

- RMI – The Rise of Batteries

- WEF – Industrial and Transportation Applications Drive Hydrogen Demand

- PIK – Electrification or Hydrogen? Both Have Distinct Roles

- Clean Energy Wire – Decarbonised Industry Will Use Much More Electricity

- Charged EVs – Freight Expert David Cebon on Electric vs Hydrogen

- IRENA – Electricity Storage and Renewables: Costs and Markets to 2030

- Green Steel: How Hydrogen is Changing the Market

- Hydrogen News & Articles

- Battery Technology Coverage

FAQ

Where does hydrogen beat batteries by 2030?

In long-haul HGVs with rapid turnarounds, deep-sea shipping (e-fuels), aviation (SAF feedstock), steel DRI, chemicals, and high-temperature industrial heat (>1,000°C).

Where do batteries dominate?

Passenger cars, LCVs, urban/regional buses, low-temperature industrial heat (<200°C), buildings (heat pumps), and grid storage up to ~100 hours.

Is this a zero-sum competition?

No. It’s allocation. Prioritise electrification where feasible; target hydrogen at sectors where chemistry, heat, or energy density make it essential.