As green hydrogen production scales, hydrogen storage becomes the linchpin for reliable supply, seasonal balancing, and affordable delivery. This guide compares leading options—physical, materials-based, and chemical carriers—summarising economics, technology readiness and best-fit applications.

Physical storage options

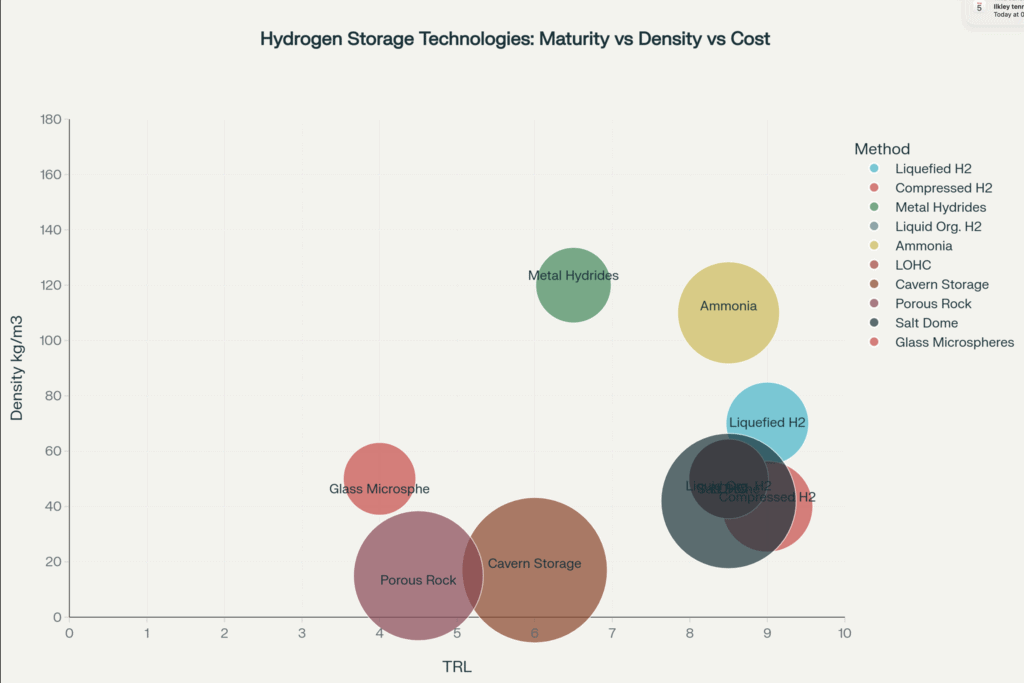

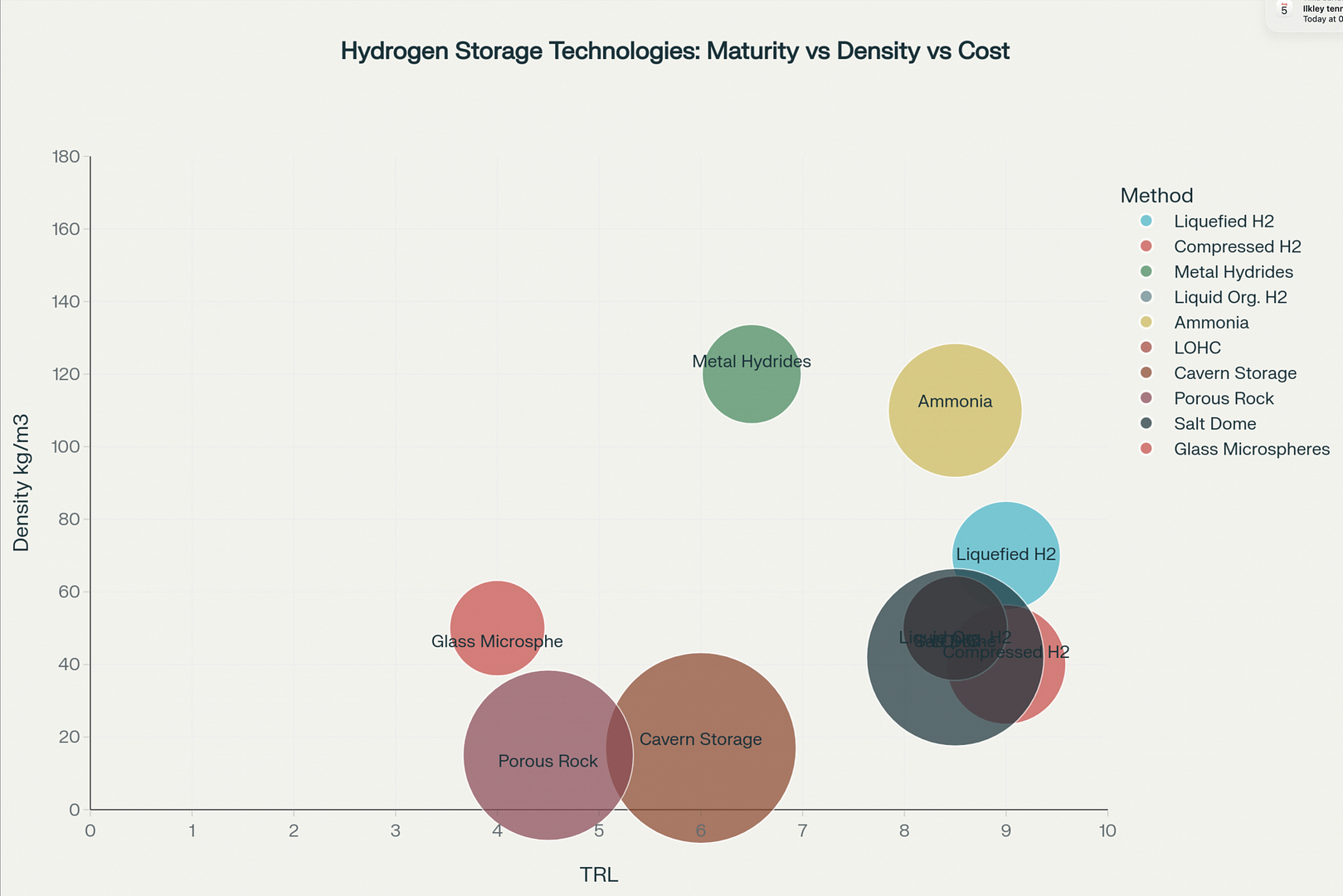

Cryo-compressed H2 (CcH2) blends compression and sub-ambient temperatures to reach higher densities than Type-IV compressed gas with less energy than full liquefaction. Typical storage density is ~45–60 kg H2/m3; TRL 6–7. Pros: compactness, reduced boil-off. Cons: complex cooling/compression hardware and higher capex than standard cylinders.

Underground hydrogen storage

Salt caverns are the near-term workhorse for bulk hydrogen storage. They’re proven with natural gas, offer large working volumes and low losses, and deliver the lowest $/kg-capacity today. Geographic dependency and long lead-times are the main constraints. Depleted fields and aquifers are being evaluated but are earlier on the TRL scale.

Materials-based storage

Metal hydrides (e.g., MgH2, complex hydrides) deliver excellent volumetric density and inherent safety, but high desorption temperatures, kinetics and weight limit use to stationary roles for now (TRL 4–8). MOFs offer huge surface areas; most require cryogenic conditions and remain TRL 3–6 pending ambient-temperature breakthroughs.

Chemical carriers for hydrogen storage

Ammonia (NH3) is the leading long-distance carrier: mature logistics, high hydrogen content and no cryogenics. Cracking efficiency and NOx management are the pain points, but TRL and supply chains are advanced. LOHCs (e.g., dibenzyltoluene, methylcyclohexane) leverage liquid handling familiarity; round-trip efficiency hinges on dehydrogenation heat and catalysts (TRL 6–7).

Emerging technologies

Glass microspheres promise safe handling and unique form factors, yet face low volumetric density and energy-intensive loading (TRL 3–5). Expect niche R&D and hybridisation with other systems.

Costs & levelized benchmarks

| Option | Indicative cost (capacity basis) | Notes |

|---|---|---|

| Salt caverns | ~$30–100 per kg H2 capacity | Lowest cost; location-dependent; long lead-time |

| Compressed gas vessels | ~$500–1,200 per kg capacity | Modular, mature, mobile |

| Liquid hydrogen | ~$100–150 per kg capacity | Higher capex, boil-off management |

| Ammonia as carrier | ~$400–800 per kg capacity | Strong for import/export and corridors |

| LOHCs | Project-specific | Heat duty & catalysts drive OPEX |

| MOFs / novel solids | $3,000–8,000 per kg capacity | Early stage; R&D-driven |

Technology readiness & outlook

- Near-term (2025–2030): Salt caverns for bulk/seasonal roles; ammonia for long-distance trade; compressed gas for mobility and modular projects.

- Medium-term (2030–2040): LOHCs and selected hydrides in stationary/industrial niches; incremental gains in CcH2.

- Watch list: Ambient-capable MOFs, better crackers, and hybrid systems that combine storage forms for cost/availability wins.

Related reading:

EV and Hydrogen Slowdowns 2025 ·

European Hydrogen Truck Manufacturers

Pingback: Hydrogen Cars in Europe 2025: Market Growth, Strategy & Infrastructure Outlook

Pingback: Green Steel and CBAM (EU): Costs, Hydrogen DRI/HBI & Compliance Guide (2025)

Pingback: Zero Emission HGVs. The startup wave broke but the freight kept moving

Pingback: Methane Impact on Climate Change: The Fastest Way to Cool the Planet in 2025

Pingback: Electric HGV Operational Challenges: 7 Critical Factors Fleet Managers Must Overcome

Pingback: Green Hydrogen & SAF Economics: PtL Costs, UK/EU Mandates, and 2040 Outlook

Pingback: ReFuelEU Aviation: Green Hydrogen & SAF Economics, PtL Costs, and 2040 Outlook

Pingback: AI Sensor Technology: How Smart Sensors Power the Real-World Future of Artificial Intelligence

Pingback: October 2025 IMO Shipping Decarbonisation Delay: Politics, Clean Fuels, and the Future of Green Maritime Policy